Follow us on :

Wealth advisors control $144.6 trillion in client assets, yet reaching them directly remains one of the toughest challenges in B2B financial services marketing. A verified wealth advisors email list gives you direct access to RIAs, CFPs, and private wealth managers without the gatekeepers.

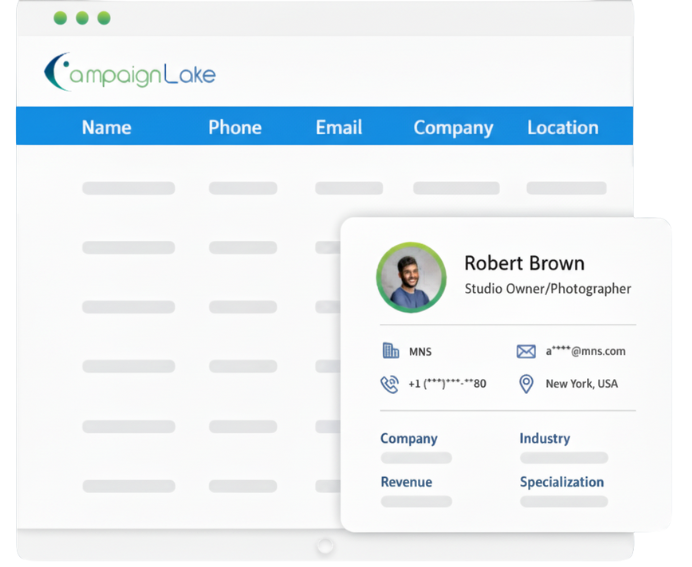

At CampaignLake, we provide a verified wealth advisors email list built for precision B2B marketing. Our database includes accurate contact details such as email addresses, phone numbers, company names, job titles, AUM range, location, and firm type. Whether you’re promoting fintech platforms, investment tools, compliance software, insurance solutions, or alternative investment opportunities, our wealth advisors mailing list helps you launch highly targeted campaigns with better open rates and higher conversions.

Verified

Opt-in Contacts

Deliverability

DataFields

A wealth advisors email list is a database of verified contact information for financial professionals who manage client assets and provide investment guidance. Providers like Megaleads, BookYourData, and CampaignLake offer segmented, GDPR-compliant databases—often with deliverability rates above 95%—that allow targeting by firm type, credentials, geography, or assets under management (AUM).

Think of it as a shortcut. Instead of manually researching advisors one by one, you get a ready-to-use collection of direct emails, phone numbers, job titles, and firm details organized for B2B outreach.

A comprehensive list typically includes:

You’ll also see this called a financial advisors email list, financial advisors mailing list, or wealth manager contact database. The terms are interchangeable depending on the provider.

Knowing exactly what data points come with a list helps you evaluate whether it fits your campaign. Here’s what reputable providers typically deliver.

Contact Information

Most lists include full name, verified business email, direct phone and mobile numbers, office mailing address, and fax number where available. Direct dials are particularly valuable since they bypass gatekeepers.

Firmographic Details

Firmographic data covers company name, firm type (RIA, broker-dealer, wirehouse, independent), AUM range, employee count, office location, and SIC/NAICS codes. This information allows you to filter by firm size or business model.

Credentials and Licenses

Professional designations like CFP, CFA, ChFC, and CLU appear alongside securities licenses such as Series 7, Series 66, and Series 65. Some lists also include state registrations and SEC or FINRA registration status.

Social Profiles

LinkedIn URLs and other professional network handles round out the contact profile. Social data supports multi-channel outreach beyond email and phone.

Not all financial advisors operate the same way. Understanding the distinctions helps you build more relevant campaigns.

RIAs are fiduciary investment advisors registered with the SEC or state regulators. They manage client portfolios on a fee-only or fee-based model and are legally obligated to act in their clients' best interests.

Broker-dealer reps execute securities transactions and usually hold Series 7 and Series 63/66 licenses. Unlike RIAs, they may earn commissions on product sales, which influences the solutions they recommend.

Wirehouse advisors work for large financial institutions with established compliance infrastructure. Independent advisors run their own practices, giving them more flexibility in choosing technology platforms and service providers.

CFPs hold a comprehensive certification covering retirement planning, tax strategies, estate planning, and insurance. They typically work with clients on holistic financial plans rather than just investment management.

Private wealth managers serve high-net-worth and ultra-high-net-worth clients with complex financial needs. Their work often includes multi-generational wealth transfer with entities like family offices, tax optimization, and alternative investments.

Family office advisors work exclusively with ultra-high-net-worth families to manage multi-generational wealth, investments, philanthropy, estate planning, and risk management. They often oversee diversified portfolios that include private equity, venture capital, real estate, and alternative assets.

Several buyer personas find significant value in verified wealth advisor contact data.

Companies selling portfolio management software, CRM tools, compliance solutions, or robo-advisor platforms use wealth advisor lists to reach decision-makers evaluating new technology.

Asset management firms, ETF providers, and alternative investment companies seek distribution relationships with advisors who can recommend their products to clients.

Agencies running campaigns on behalf of financial services clients rely on accurate advisor data to execute email, direct mail, and account-based marketing programs.

Hosts of industry conferences, webinars, and CE credit events target financial professionals who benefit from continuing education and networking opportunities.

Recruiters filling advisory roles at RIAs, broker-dealers, and wealth management firms use wealth advisor lists to identify and contact qualified candidates—according to Cerulli Associates, 109,093 advisors plan to retire over the next decade.

Companies offering drug distribution, cold chain logistics, inventory optimization, and procurement solutions rely on pharmacy directors to drive vendor partnerships. These leaders oversee medication sourcing and supply continuity, making them critical contacts for supply chain outreach.

A verified wealth manager contact database supports multiple campaign types beyond basic email marketing.

Use the list for newsletters, product announcements, thought leadership content, and nurture sequences. Personalization based on credentials or firm type typically improves open and response rates.

Direct phone numbers enable sales outreach and appointment setting. Combining email with phone follow-up often increases conversion rates compared to single-channel approaches.

Social profile data allows you to connect with advisors on professional networks. LinkedIn outreach works particularly well for relationship-building and content sharing.

Mailing addresses support physical mailers, brochures, and event invitations. Direct mail often stands out when inboxes are saturated.

Using a financial advisors mailing list strategically can significantly improve engagement, response rates, and overall campaign ROI. Instead of sending generic mass emails, successful marketers apply structured segmentation, personalization, and compliance-driven processes to maximize results.

Below are the key best practices you should follow:

CampaignLake delivers a verified, compliance-ready wealth advisors email list built for targeted B2B outreach.

very record passes a 7-tier verification process combining AI validation and human review

Regularly refreshed database minimizes bounces and wasted outreach

Receive data in CSV or Excel formats compatible with Salesforce, HubSpot, and Marketo

Filter by credentials, AUM, firm type, geography, and custodian platform

Adherence to GDPR, CAN-SPAM, CCPA, and CASL regulations

Evaluate data quality before purchasing

Understanding where data comes from helps you evaluate its reliability.

Quality providers pull from multiple sources: SEC/FINRA filings: Publicly registered advisor and broker records Professional associations: CFP Board, CFA Institute, FPA membership directories Industry conferences: Attendee lists from wealth management events Opt-in networks: Advisors who've consented to receive business communications

Quality providers combine automated and manual validation. The process typically includes email syntax and domain verification, SMTP validation to confirm deliverability, phone number verification, cross-referencing against regulatory databases, and human review for accuracy.

Top providers regularly update and cleanse their databases to remove outdated contacts, track job changes, and ensure compliance with data regulations. Ongoing refresh cycles help maintain high deliverability, reduce bounce rates, and keep your campaigns aligned with current privacy and consent standards.

Want to see the quality of our data before you invest? We make it easy. Request a free sample of our Wealth Advisors Email List and evaluate the accuracy, segmentation depth, and deliverability for yourself.

Make Your Marketing Goal as specific as possible and get in touch with CampaignLake at reach@campaignlake.com or call +1 (657)-347-3363 to avail our highly responsive Wealth Advisors Email List!

Reputable providers allow filtering by professional designations during the list-building process. You can request only advisors holding specific certifications such as CFP, CFA, ChFC, or particular securities licenses.

AUM segmentation typically includes ranges such as under $100M, $100M–$500M, $500M–$1B, and over $1B. Exact tiers vary by provider, so confirm available options before purchasing.

RIA lists contain fee-only fiduciary advisors registered with the SEC or state regulators. Broker-dealer lists include commission-based representatives who sell securities products and typically hold Series 7 licenses.

Delivery timelines vary by provider and customization requirements. Most lists are delivered within a few business days in CSV or Excel format, though complex custom builds may take longer.

Verified, opt-in lists from reputable providers typically achieve inbox placement rates above 95%. Actual results depend on your sending reputation, email content, and list hygiene practices.

Yes. Most providers offer custom list builds filtered by firm type, so you can request independent RIAs, wirehouse advisors, broker-dealer representatives, or other specific segments.

Providers commonly accept credit cards, PayPal, bank transfers, and Stripe. Some vendors, including CampaignLake, also accept cryptocurrency payments.